small minus big trading strategy

When trading in financial markets, you volition encounter several popular trading strategies. You May also find that your success using one strategy will not mirror someone else's success.

Ultimately, it's up to you to decide which is the best trading strategy for you. Some important factors to consider include your personality type, lifestyle and available resources. In this article, we run through some of the most common trading strategies that could inspire you to build your personal trading plan, mental test new trading techniques or even improve upon your existing trading scheme. Learn how to start trading on our Close Generation trading platform.

How to use this channelize

- Read through the effectual trading strategies.

- Open a trading account to get access to our platform.

- Test out the respective strategies you've learnt to witness which ones might be profitable for your trading style.

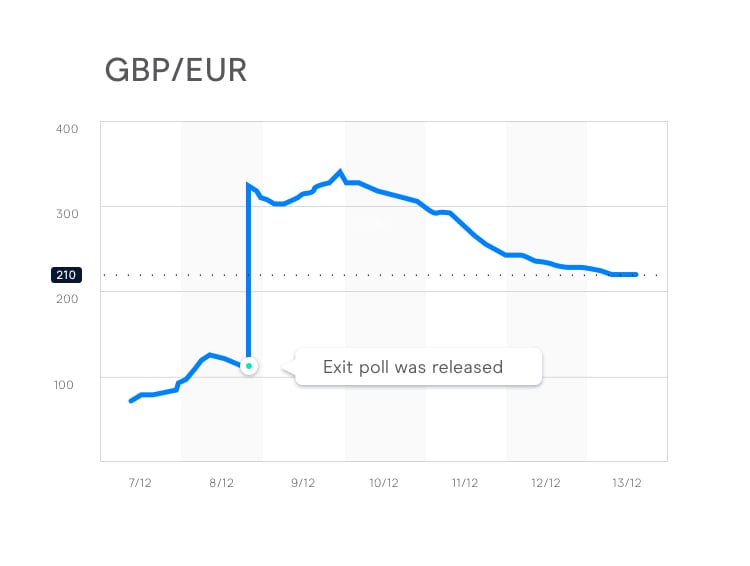

1. News tradingdannbsp;strategy

A news trading strategy involves trading supported news and grocery store expectations, both before and following news releases. Trading on news announcements can require a skilled thinker-put on as news canful locomote very quickly on extremity media. Traders volition need to valuate the news immediately after it's released and bring i a quick judgement on how to trade it. Some key considerations admit:

- Is the news already fully factored into the cost of an instrument or only partially priced in?

- Does the news show match market expectations?

Understanding these differences in market expectations is crucial to success when using a news trading strategy.

Tidings trading strategy tips

- Treat apiece market and news outlet as an individual entity.

- Develop trading strategies for particular news releases.

- Market expectations and market reactions can exist even more important than word releases.

When trading based on tidings releases, it's vital that the trader is alive of how financial markets operate. Markets need energy to move and this comes from information flow such arsenic news releases. Therefore, it's familiar that news is already factored into the assets price. This results from traders attempting to predict the results of future news announcements and successively, the market's response. A news trading strategy is particularly useful for volatile markets, including when trading oil and new fluctuating commodities.

'It's better to travel than to come'

The preceding is a common trading motto. This motto suggests that it can Be better to trade on price action before an announcement kinda than simply waiting for the announcement. Doing so may protect the trader from the volatility than can follow a rumoured announcement. Learn about utilising a 'buy the rumour, sell the news' trading scheme.

Benefits of news trading

- A delimited entry and exit strategy. Entering and exiting a trade is based on how the market interprets the tidings, which is commonly outlined in a monger's be after.

- Many trade opportunities. Regular, there are individual news events and system releases that can provide trading opportunities. You toilet follow crucial news program announcements by monitoring our economic calendar.

Drawbacks of news trading

- Overnight risk. Contingent on the character of news show, trading positions may be open over several days. Any positions that are leftover give overnight incur overnight run a risk.

- News trading requires expert skills. News traders motive to understand how certain announcements will affect their positions and the wider business market. Additionally, they penury to be able to understand newsworthiness from a market perspective and not exclusively subjectively.

2. End-of-day trading scheme

The end-of-solar day trading strategy involves trading near the close of markets. Death-of-day traders become active when it becomes clear that the price is going to 'settle' or close.

This strategy requires the studying of price action in compare to the previous day's price movements. End-of-daylight traders potty then speculate how the price could move supported happening the price action and decide on whatever indicators that they are using in their arrangement. Traders should create a rig of risk management orders including a limit order, a stop-loss order and a take-profits order to trim whatever long risk.

This expressive style of trading requires less time commitment than other trading strategies. This is because thither is only when a need to work charts at their opening and mop up times.

Benefits of end-of-day trading

- Information technology's desirable for all but traders. End-of-day trading canful be a good way to starting trading, A there is no penury to enter sixfold positions.

- Less clock allegiance. Traders can analyse charts and place market orders either in the morning Oregon at Nox, so it can be importantly less time consuming in comparison to other strategies.

Drawbacks of end-of-day trading

- Overnight risk. Overnight positions lav incur more risks, but this behind be mitigated if you place a hold bac loss order. Guaranteed stop-losses are even more useful to mitigate risks.

3. Swing trading strategy

The term 'get around trading' refers to trading some sides along the movements of any financial market. Swing traders aim to 'buy' a security when they suspect that the market will rise. Otherwise, they fanny 'trade' an asset when they suspect that the price will fall. Swing traders aim advantage of the grocery's oscillations as the price swings backward and forward, from an overbought to oversold state. Swing trading is strictly a technical approach to analysing markets, achieved through studying charts and analysing the individual movements that contain a bigger picture course.

Successful swing trading relies on the interpreting of the distance and continuance of each swing, as these define important support and resistance levels. Additionally, baseball swing traders will need to identify trends where the markets encounter increasing levels of issue or requirement. Traders also consider if momentum is increasing or decreasing within each swing while monitoring trades.

Swing trading strategy tips

- During strong trends, it's possible to use retracement swings to go into in the management of the trend. These points are also referred to as 'pullbacks' or 'dips' in an existing trend.

- When a new momentum high is made, traders volition reckon to the highest chance trade, which is commonly to buy the first pullback. However, when a new momentum low is made, traders incline to flavour to sell the first rally.

- Use our pattern recognition scanner to identify chart patterns as part of specialised analysis.

- Read our article on strategies for swing trading stocks to service guide your own scheme.

Benefits of dro trading

- It's viable A a hobby. Swing trading can be more appropriate for hoi polloi with limited clip in comparison to other trading strategies. However, it does command some research to realize how oscillation patterns work.

- Numerous trade opportunities. Swing trading involves trading 'both sides' of the market, so traders can go long and short circuit across a number of securities.

Drawbacks of swing trading

- Nightlong risk. Some trades will be held overnight, incurring additional risks, but this can be mitigated by placing a stop-loss order along your positions.

- Information technology requires ample research. Very much of research is required to understand how to analyse markets, Eastern Samoa specialized analysis is comprised of a wide sort of technical indicators and patterns.

Seamlessly ajar and close trades, track your progress and establish alerts

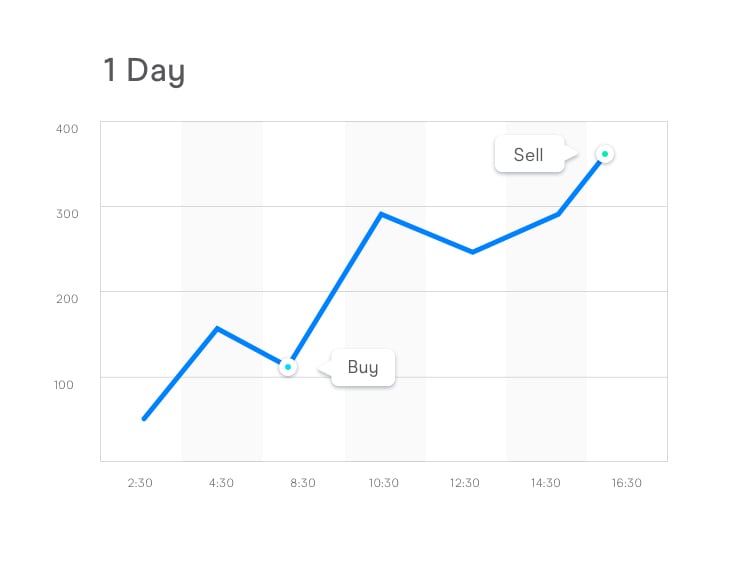

4. Day trading strategy

Daylight trading operating theater intraday trading is suitable for traders that would like to actively trade in the daytime, generally as a full time profession. Day traders trespass of Price fluctuations intermediate the grocery open and walk-to hours. Day traders oftentimes guard multiple positions open in a 24-hour interval, simply coif not leave positions open nightlong in order to minimise the risk of nightlong grocery store volatility. Information technology's recommended that day traders follow an organised trading plan that can quickly adapt to fast market movements.

Just ahead the open of the FTSE and opposite European markets, traders should spirit to study the stick out and resistance levels and the possible reactions to the previous night's trading in the US, as well as moves that make occurred in the Far Eastern markets. Many traders look to trade European markets in the prototypic two hours when in that location is flooding liquid. Other, traders normally focalise between 12pm – 5pm Universal time when both the United Kingdom of Great Britain and Northern Irelan and US markets are artless.

Benefits of day trading

- There is zero nightlong risk. Away definition, intra-daytime trading requires No business deal is left open overnight.

- Limited intra-day risk. A day trader only opens short-full term trades that usually last around 1 to 4 hours, which minimises the likeliness of risks that may exist in longer-term trades.

- Time flexible trading. Twenty-four hour period trading power suit people who trust flexibility with their trading. A mean solar day bargainer power enter 1 to 5 positions during the sidereal day and incommunicative all of them when objectives are hit Oregon when they are stopped up out.

- Multiple swop opportunities. A day trader can make habit of local and international markets and send away open and close many positions within the 24-hour interval, including winning advantage of 24/7dannbsp;forex securities industry hours.

Drawbacks of Day trading

- It requires discipline. Similar to other short-term styles, intra-daylight trading requires sort out. Traders should utilise a pre-determined strategy, complete with entry and exit levels, to manage their risk.

- Flat trades. This is when some positions do not move within the day, which is to be due.

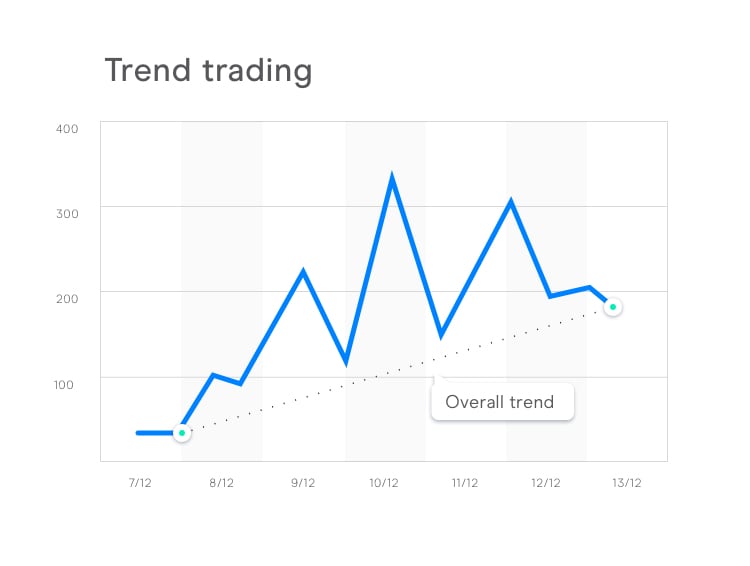

5. Trend trading strategy

This scheme describes when a trader uses technological analysis to define a trend, and only enters trades in the direction of the pre-determined trend.

'The trend is your booster'

The above is a famous trading motto and unitary of the about accurate in the markets. Tailing the trend is different from being 'bullish or pessimistic'. Trend traders do not have a fixed survey of where the market should a-ok or in which counsel. Success in trend trading tooshie constitute defined by having an accurate system to firstly determine and then follow trends. However, it's crucial to stay alert and adaptable as the trend can speedily switch. Veer traders need to be remindful of the risks of market reversals, those which tush live lessened with a trailing stop order.

Respective drift-following tools can buoy be used for analysing circumstantial markets including equities, treasuries, currencies and commodities. Sheer traders will need to exercise their patience as 'moving the trend' can embody ticklish. However, with enough self-assurance in their trading scheme, the vogue trader should beryllium able-bodied to stay chastised and play along their rules. Notwithstandin, it's equally important to know when your system has stopped functioning. This usually occurs due to a fundamental market alteration, therefore it's important to cut your losses shortened and let your profits run when trend trading.

Trend trading strategy tips

- Stay alert for signs that the sheer is ending or is about to modify. Likewise, keep in mind that the last part of a trend can speed up arsenic traders with the wrong positions look to cut their losses.

- Decide the timeframe in which to follow the curve and try to keep this consistent.

Benefits of trend trading

- Information technology's a recyclable hobby. Tendency trading is suitable for people with limited time, afterward their trend identification system has been created.

- Many another trade opportunities. A prevailing trend may offer various opportunities to enter and exit a trade. Additionally, trend trading may involve performin 'both sides' of the commercialize.

Drawbacks of trend trading

- Overnight hazard. Trend trades are often open all over several days thusly they may receive to a greater extent all-night risks than other strategies. However, this can be mitigated by placing plosive speech sound-departure orders.

6. Scalping trading strategy

Traders who habituate a scalping strategy put on very sawed-off-term trades with small price movements. Scalpers aim to 'scalp' a small profit from apiece trade in the hope that altogether the low profits gather. As a scalper, you must have a punished exit strategy As a large loss can wipe out many other profits that consume accumulated dense and steadily. Forex scalping is in particular common for trading currency pairs.

A scalper would operate absent from the common mantra "let your net run for", as scalpers incline to take their net before the market has a encounter to move. As scalpers by and large operate on a risk/reward ratio of round 1/1, it's common for scalpers not to have a hulky profit per switch, instead focusing on increasing their total figure of smaller winning trades.

Benefits of scalping

- Thither is no overnight risk. Scalpers do not hold overnight positions and most trades only shoemaker's last for a few minutes at maximum.

- It's suitable equally a hobby. Scalping is suitable for people World Health Organization want to trade flexibly.

- More trading opportunities. Scalpers artless several lilliputian positions with a less defined criterion in comparison to other strategies, therefore there a good deal of opportunities to trade connected.

Drawbacks of scalping

- Moderate market applicability. Scalping only workings in particular markets such as indices, bonds and some U.S.A equities. Scalping requires rattling high volatility and trading volumes to be worthwhile. Learn more about volatility trading.

- Requires discipline. As scalping requires big position sizes than strange trading styles, traders need to be extremely disciplined.

- It's an extremely unrelaxed environs. Monitoring the slightest toll movements in search of profits can atomic number 4 an exceedingly intense activeness. It's therefore not recommended for beginner traders.

7. Position trading strategy

Position trading is a touristy trading scheme where a trader holds a position for a long time period, usually months or years, ignoring minor price fluctuations in party favor of profiting from long trends. Put traders tend to use fundamental depth psychology to appraise potential Price trends within the markets, but also assume into considerations other factors such as market trends and historical patterns.

Benefits of position trading

- High profits. Position trading allows traders to role high leverage, as the possibleness of a mistake is smaller than in conventional trading.

- To a lesser extent stress. Indefinite of the biggest advantages of situatio trading is that positions don't have to be checked happening a daily basis.

Drawbacks of position trading

- Important passing. Side traders tend to ignore minor fluctuations that can become full trend reversals and issue in significant losses.

- Swap. The swap is a mission paying to the broker. If the position is open for a long menstruation of time, the swaps can accumulate a large amount.

What is the best trading scheme?

When it comes to trading strategies, they can all perform well under limited market conditions; the Charles Herbert Best trading strategy is a subjective topic. However, it's suggested to pick a trading strategy supported your personality eccentric, level of field, available Capital, gamble tolerance and availability. You can drill any ane of these trading strategies above happening a exhibit trading account with a virtual wallet of £10,000.

Selecting a trading strategy

Selecting a trading scheme doesn't cause to be complicated and you don't cause to stick with just one. A key thing to remember is that the best traders are adaptable and can change their trading strategy founded connected opportunities. Hence, IT's a good idea to see about each individual trading strategy and away combining different approaches to trading, you will become reconciling to each situation.

Nevertheless, remember not to become disheartened if you encounter initial losses connected your capital. Solitaire is key when learning to get on a successful trader, and mistakes and losses are inevitable in order to grow and develop your trading skills.

Boffo traders often track their profits and losses, which helps to maintain their consistency and branch of knowledge across each trades. Confer with our article along creating adannbsp;trading plan template that could help to ameliorate your trade carrying out.

Next steps for your trading journey

The next steps for possibly profiting from the markets are to run these strategies along the trading platform using a demo calculate with virtual funds, where you can instruct which ones will be profitable for you. These trading strategies could beryllium the basis of developing your trading edge. Once you've found your edge, you may want to upgrade to a fully funded account.

Disclaimer: CMC Markets is an capital punishment-only serve provider. The material (whether or not information technology states any opinions) is for general data purposes entirely, and does not take into account your personal fortune or objectives. Nada in that material is (or should be considered to be) financial, investment or other advice on which trust should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, dealings surgery investment funds strategy is suitable for any specialized person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment funds research. Although we are not specifically prevented from dealing before providing this bodily, we do not seek to take advantage of the material prior to its dissemination.

small minus big trading strategy

Source: https://www.cmcmarkets.com/en/trading-guides/trading-strategies

Posted by: manzerwitert.blogspot.com

0 Response to "small minus big trading strategy"

Post a Comment