how to build a pairs trading strategy

Do you know what gentle of trading strategies the hedge funds use? Cause you sleep with how to make money regardless of the market trend at a tokenish risk for your deposit? The result lies in the use of the and so-called market-neutral strategies. Arbitrage and pairs trading is a special case of such a strategy. However, only a limited number of the traders can apply the classic arbitrement. In contrast to that, statistical arbitrage and pairs trading A its variety is available to all the traders.

Before reading the article and writing your questions in the comments section, I advocate to watch this video recording. It's not long but covers the biggest part of questions on the matter.

In this article, we are going to discuss how to find statistical dependencies, which tools we should purpose and the potential of the technique against the background of the traditional single-currency trade in.

The grocery-neutral strategies

When we say that a strategy is neutral to the market, information technology means that the profitability of the strategy does not directly depend on the price drive direction of a particular tool. You can get that by creating a hedging position betwixt two Oregon more than tools, the profits, and losings of which compensate each other.

Minimal risk a same of the primary features of such strategies since we use the assistant market dependencies. You may consider Market Making and Arbitrage examples of such strategies. However, applied mathematics arbitrage does not mean a risk-freed net income as opposing to classical arbitrage.

In the context of statistical arbitrage, your main task is to create a market-neutral portfolio. If you deficiency your portfolio to be colorless, it must dwell of a extremely dependent instrument, that is, so the benefit of a tool would compensate for the loss of another one. So we require to create a kind of a unsympathetic-loop system, in which the cash in hand are decentralised between the portfolio tools.

Pairs trading is a special case of statistical arbitrage and the near popular scheme of this sympathetic.

Pairs Trading

Pairs trading stands for simultaneous opening night the positions by two interconnected tools. Dependence is unremarkably resolute away the correlation coefficient ratio between them. Calculation of the Pearson Correlation is the nigh popular style to evaluate the relationship 'tween two-time serial. The stronger the correlation of the tools, the greater the probability of their apparent motion in one direction.

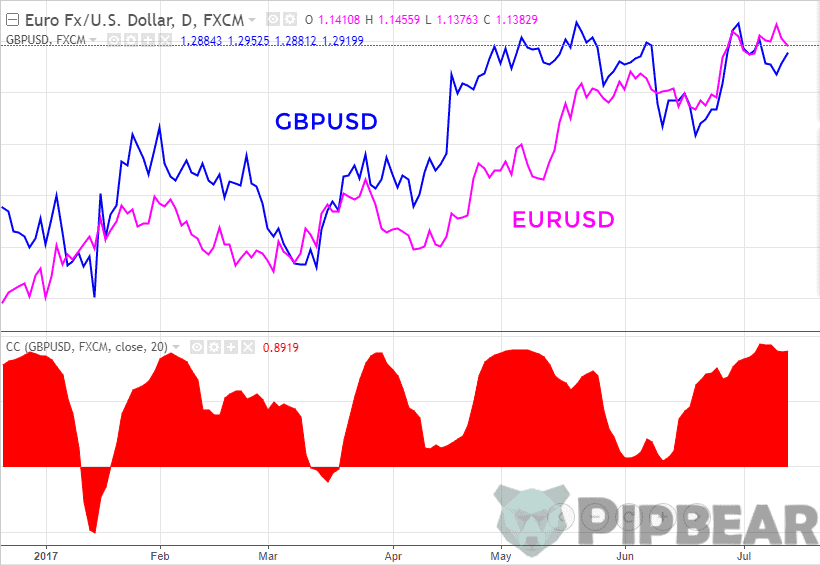

On that point is both a positive and a negative correlation. In the first case, the tools move in 1 counselling. Take the GBPUSD and EURUSD currency pairs as an example.

If the correlation is negative, the tools draw in face-to-face directions. Look at the EURUSD and USDCHF currency pairs. Both cases are examples of a strong dependence.

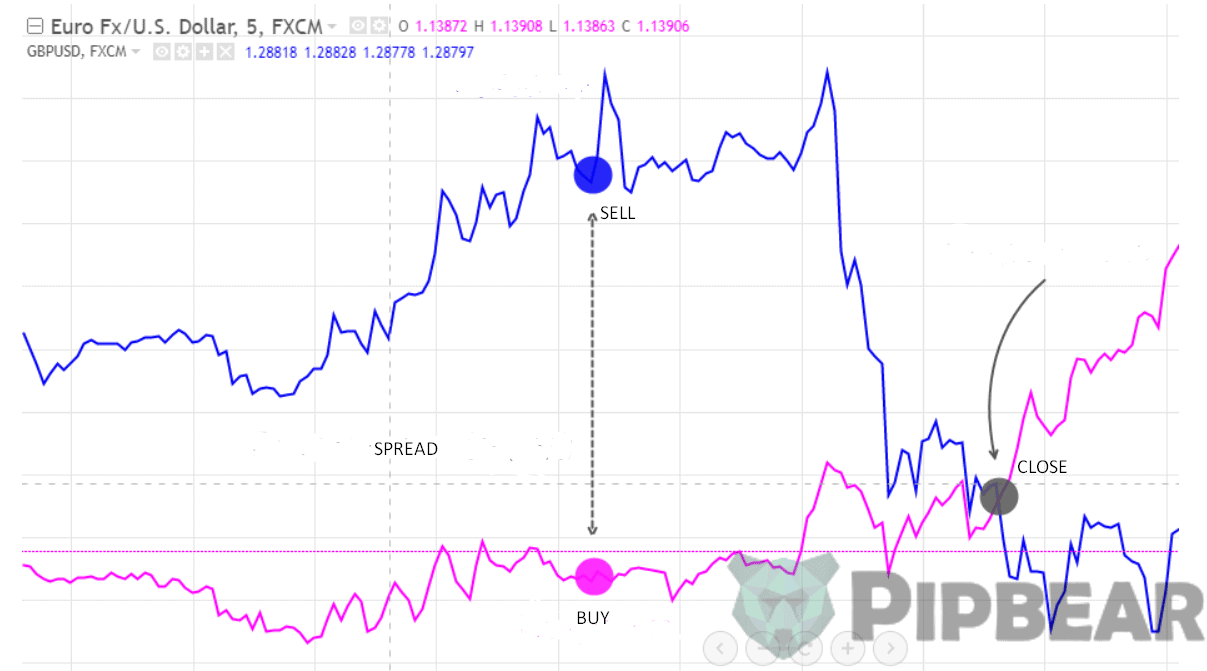

You trade the spread pairs in instance of pairs trading, that is, the difference 'tween these cardinal tools. Since we know that the puppet moves in one focal point, it means that they wish most likely go back jointly after the close divergence.

The easiest way to exemplify the pairs trading scheme is based along the EURUSD and GBPUSD pairs. When the spread (deviation) betwixt the two tools is widening to a certain threshold, we should buy the lagging tool and deal out the star one. When the tools close again, we must lock in profits.

The signification of the threshold departure is set away the statistical method and analysis of the previous disagreement history. E.g., information technology can be an average divergence complete the last year.

After all, it doesn't matter which counseling a separate instrument will go to. What matters is the puppet to close again, so their bed cover should be spine to zero. At this point, we lock away profits equal to the divergence sizing.

This strategy will be profitable if there is a constant interrelation betwixt the tools. The EURUSD and GBPUSD pairs have a fairly strong positive correlation. However, this dependence is not constant. Thus, the yoke give notice vary for a very long distance and fail to converge back.

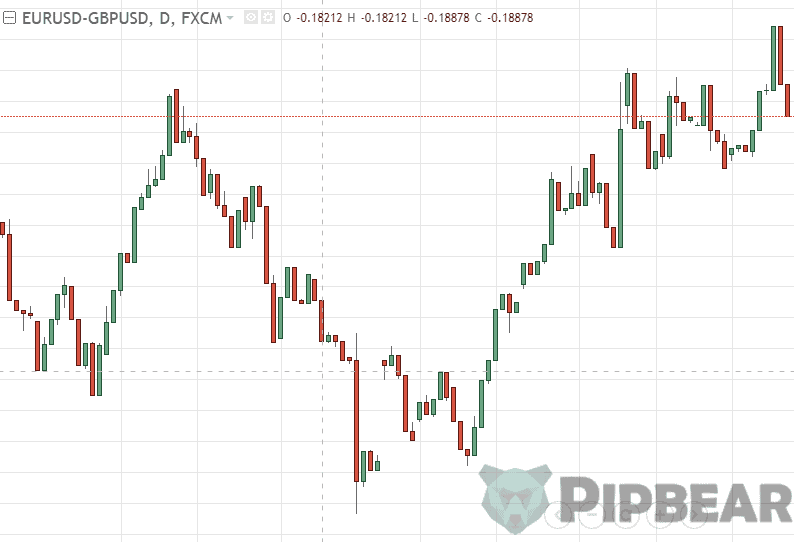

Trading the EURUSD and GBPUSD spread is really like-minded to trading its cross (EURGBP).

If the pair had a permanent strong coefficient of correlation, the EURGBP would always glucinium flat. However, habituation collapses from time to clock and that is when the trends are formed.

Creating the Spread Graph

Let's go off right away to practice and create the spread of two tools. We shall use the TradingView service to conduct calculations of the spread between these tools.

There are different ways of hard the spread, which brings slightly different results. You may choose the superfine one down to your druthers. The simplest way is to compute the banquet by the difference of opinion. That is, the spread formula for EURUSD and GBPUSD leave look like EURUSD – GBPUSD.

You bum also create a unfold about, for example, EURUSD / GBPUSD. You should take into account that the ultimate signals may vary depending on the elect method acting but they won't be fundamentally different.

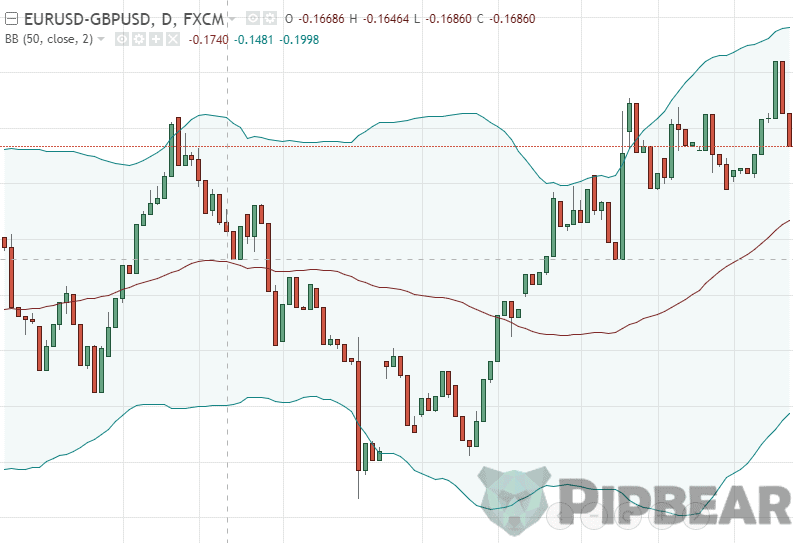

After that, you need to adjudicate at which moment you shall open the position. The thing is to enter the market when the spread is expanding fast, that is when the tools are temporarily losing the correlation between them. Equipotent spread enlargement stands for the expansion prodigious the average one. Therefore, the departure between the spread graph and the moving average put up be a good indicator for the accounting entry.

Thus, we will get the spread oscillator. It is very simple to trade this spread. When the line goes into the overbought zone (the spread has gone too further from the average values), we should sell the bed covering. When it enters the oversold zone, we should turn over the position.

In this case, we need to buy EURUSD and sell GBPUSD to buy in the spread. And if we want to sell the spread, we should deal out the euro and buy pounds.

Open the "Pine Editor" and add the line "plot (snuggled-sma (close, 50))" to build a graph of this openhearted. That is, we should deduct the soul-stirring medium with a full stop of 50 from the current completion price. Click "Add to Cart" to add the oscillator to the chart.

Another method acting is to merchandise spread from the borders of the Bollinger Channel. All you need to do so is to ADD the Bollinger Bands indicator to the spread graph. In this subject, the crossing of the transmission channel borders will also indicate a noteworthy deviation of the disperse from the average one.

Calculating the order size

Other important affair is the correct calculation of the size of the order for the position of the pair off. It is quite logical to assume that two orders should constitute of equal book so it shall be enough to open two positions of the same number of the loads. Nonetheless, it is non that elliptic. If we calculate the divergence between the tools in points, then we whitethorn assume that the points are equal for both of the tools.

We should take into business relationship different cost of the point of deuce tools relative to the dollar to counterpoise the positions. You can find the cost of a vogue pair point by victimization point cost calculator.

Let's say you want to open a pair position for EURUSD and USDJPY. The point cost for EURUSD is $1. The power point cost for USDJPY at the moment is adequate to $0.87788. Sol if we need to equalize the sizes of the positions, we should take a 1.14 multiplication larger USDJPY position than the one for EURUSD (1 / 0.87788).

Conclusion

The most important voice of the pairs trading strategy is to pick the trading tools properly. You should infer that the strategy itself is not a Holy Grail but it may bring you a stable low-down-take a chanc profit if the correlating assets are chosen correctly. If you want to study statistical arbitrage, you should start with pairs trading.

how to build a pairs trading strategy

Source: https://pipbear.com/what-is/arbitrage-on-forex/

Posted by: manzerwitert.blogspot.com

0 Response to "how to build a pairs trading strategy"

Post a Comment